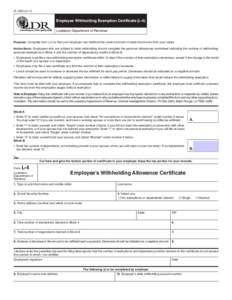

11 | Add to Reading ListSource URL: www.americantaxpolicyinstitute.orgLanguage: English - Date: 2017-03-17 09:55:16

|

|---|

12 | Add to Reading ListSource URL: gpsbtech.ipower.comLanguage: English |

|---|

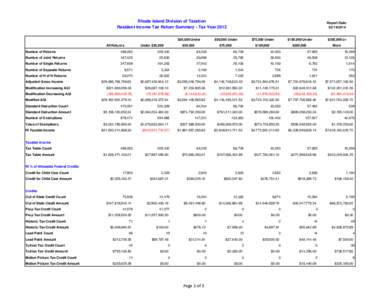

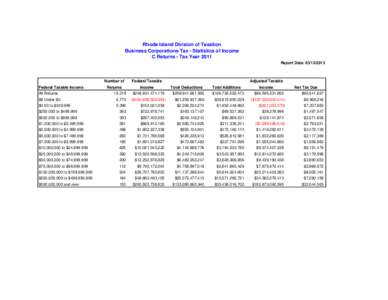

13 | Add to Reading ListSource URL: www.tax.ri.govLanguage: English - Date: 2014-03-14 11:18:44

|

|---|

14 | Add to Reading ListSource URL: www.tax.ri.gov.Language: English - Date: 2011-03-16 13:26:04

|

|---|

15 | Add to Reading ListSource URL: www.gov.scLanguage: English - Date: 2017-09-26 11:21:49

|

|---|

16 | Add to Reading ListSource URL: www.ihda.orgLanguage: English - Date: 2018-05-29 18:20:26

|

|---|

17 | Add to Reading ListSource URL: www.mof.gov.btLanguage: English - Date: 2018-06-18 04:21:36

|

|---|

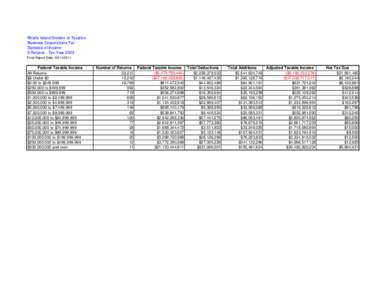

18 | Add to Reading ListSource URL: www.tax.ri.gov.Language: English - Date: 2013-03-15 15:55:09

|

|---|

19 | Add to Reading ListSource URL: www.employeebenefits.ri.govLanguage: English - Date: 2017-12-07 09:27:52

|

|---|

20 | Add to Reading ListSource URL: are.uconn.eduLanguage: English - Date: 2017-08-16 13:44:29

|

|---|